In the first half of 2025 (H1 2025), Nigeria’s economic narrative was one of fragile stability, shaped by the gradual gains of ongoing reforms amid entrenched structural challenges on the domestic front and persistent global uncertainties. While concerted efforts to revitalise the oil sector, enhance fiscal governance and stabilise the national currency yielded discernible, albeit modest, gains, the spectres of stubbornly high inflation, exchange rate volatility and substantial debt servicing costs continued to cast long shadows over the nation’s economic stability.

A Challenging Global Environment – Headwinds from Afar

In H1 2025, the global economic environment was characterised by a notably subdued climate. Trade frictions, policy uncertainties and a marked deceleration in China and other leading economies imposed significant constraints on capital flows to emerging markets. Despite easing inflationary pressures in advanced economies, benchmark interest rates remained elevated relative to the pre-pandemic baseline, sustaining a tight global monetary stance. This external environment constrained capital flows to developing nations, putting pressure on external reserves and exchange rates. Nevertheless, amidst these global headwinds, some emerging markets, including Nigeria, found a degree of respite. A weaker US Dollar, which saw a decline of 10.7% in H1 2025, coupled with Nigeria’s nascent currency stability, moderating inflation and robust corporate earnings, collectively fuelled a notable boom in its equities market. The NGX All-Share Index, for instance, recorded an impressive gain of 16.6% in H1 2025, reflecting a cautious optimism among investors.

Resilient Growth

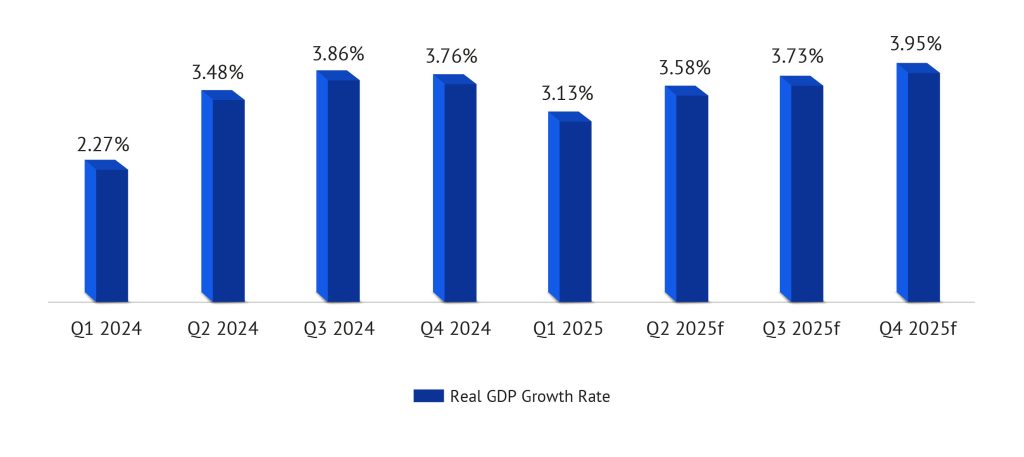

Following the National Bureau of Statistics’ (NBS) release of Nigeria’s rebased GDP figures, which placed nominal GDP for 2024 at approximately ₦372.8 trillion (US$242.64 billion), the economy recorded a real GDP growth rate of 3.13% in Q1 2025, a marked improvement over the 2.27% achieved in Q1 2024. The Services sector was the principal driver, expanding by 4.33%, underpinned by robust growth in the Financial Services (15.03%) and (7.40%) sub-sectors. Although oil production improved to an average of 1.62 million barrels per day (mbpd) (Q1 2024: 1.57 mbpd), it remained below both budgeted expectations and OPEC+ limits, constrained by persistent issues such as theft and infrastructure sabotage.

Inflation: A Gradual but Stubborn Descent

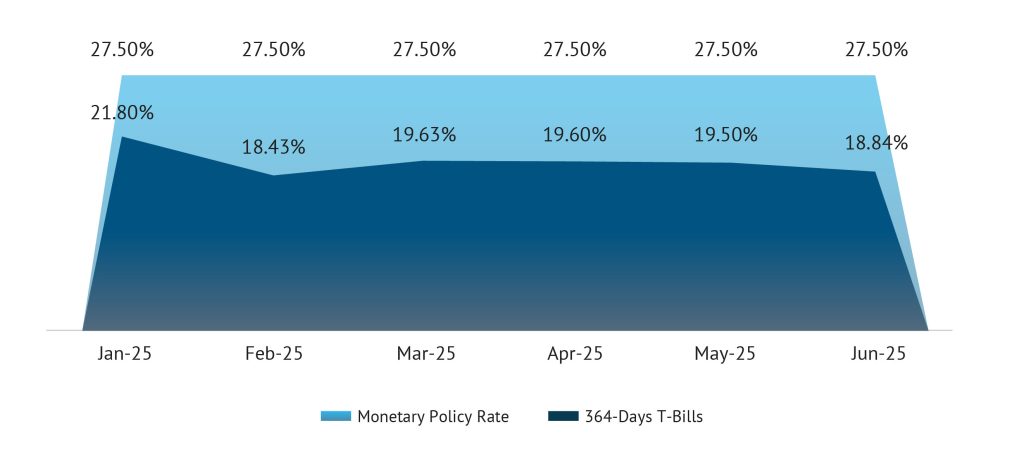

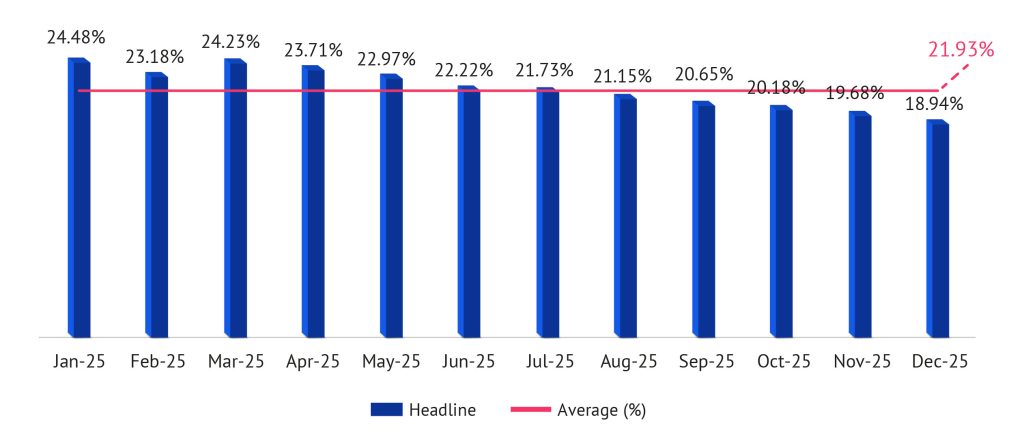

Inflationary pressures showed discernible moderation, with headline inflation easing to 22.22% by June from 24.48% in January 2024. Food inflation declined to 21.97% from 23.51%, reflecting subdued monthly price rises and statistical base effects. Core inflation, however, lingered at a concerning 22.76% (January 22.59%), indicative of ongoing price rigidity in the economy. Nonetheless, the underlying drivers of inflation – the pervasive pass-through effects of a weaker naira, energy pricing and deep-seated structural issues affecting food supply chains – remained potent. In response, the Central Bank of Nigeria (CBN) maintained a hawkish monetary stance, keeping the Monetary Policy Rate (MPR) steady at 27.5% throughout H1 2025.

The Monetary Policy Committee underscored the necessity of anchoring inflation expectations and attracting portfolio inflows to stabilise the naira.

Figure 1: Monetary Policy Rate (%) vs 365-day Treasury Bills (%)

Source: CBN

The Naira’s Search for a True North:

A key stabilising factor in the macroeconomic equation was the naira’s relatively narrow trading range of ₦1,550–₦1,635 to the dollar in H1 2025. This stability contrasts sharply with the volatility experienced over the previous two years and has been underpinned by enhanced transparency through the Electronic Foreign Exchange Matching System (EFEMS), improved external reserves and credible Central Bank interventions.

The CBN’s considerable dollar supply injections, totalling approximately $4.1 billion in H1 2025 – more than double the prior year’s comparable period – attenuated speculative pressures and aligned exchange rates with underlying fundamentals. However, this strategy exacted a toll on external reserves, which declined from over $40 billion in January to circa $37.2 billion as at 30 June 2025. Despite this drawdown, reserves remain adequate within a controlled adjustment framework.

Fiscal Pressures and the Debt Question

Public debt expanded to ₦149.39 trillion as of March 2025, representing a 22.8% year-on-year increase, reflecting both nominal borrowing growth and exchange rate depreciation. External debt rose sharply to ₦70.63 trillion ($45.98 billion) year-over-year, primarily due to the depreciation of the naira and increased exchange rate exposure, while domestic debt increased to ₦78.76 trillion. The debt portfolio’s significant foreign currency component (c.47.3% as at March 2025) elevates vulnerability to currency fluctuations. The debt-service-to-revenue ratio remains a critical pressure point, driven by elevated interest costs on existing borrowings and a subdued revenue performance, particularly from non-oil sources.

The GDP rebasing exercise, however, offers a silver lining. The larger GDP size has lowered the debt-to-GDP ratio to 39.4% from 52.13%, below both the government’s 40% threshold and the World Bank’s 55% guideline. Nonetheless, the low tax-to-GDP ratio of 13.5% in 2024, now eroded further by a larger GDP base, reaffirms the urgency of expanding and improving tax collection mechanisms.

The Outlook for H2 2025: Navigating the Crosscurrents – Cautious Optimism

As Nigeria enters the second half of the year, the economic outlook remains cautiously optimistic. The path forward will be shaped by the government’s ability to sustain its reform momentum, navigate external risks and translate policy actions into tangible improvements for its citizens.

The Path to Modest Recovery

Given the stronger-than-expected start to the year, we project a slightly improved GDP growth rate for the second half of 2025, bringing the full-year growth forecast to 3.6%. This outlook is predicated on several factors. Firstly, we anticipate a further marginal increase in oil production, supported by ongoing security efforts. Secondly, the non-oil sector is expected to remain the primary engine of growth, with the ICT and financial services sectors maintaining their robust performance. Furthermore, a gradual moderation in inflation could ease the pressure on consumer demand, providing a modest boost to the trade and manufacturing sectors. Nonetheless, risks such as potential global slowdowns, domestic security threats, and policy uncertainties remain salient.

Figure 2: Real GDP Growth (%)

Source: NBS, Agusto & Co. forecast

Inflation: A Slow Descent from the Peak?

Further moderation in inflation is expected, contingent on continued stability in the FX market, timely implementation of energy sector projects and easing supply constraints in agriculture. The high base effects from 2024 will also contribute to a statistical slowdown, particularly in Q4 2025. As a result, we forecast that inflation will decline gradually to 19.5% by year-end and average 21.9% for the year.

We believe that the CBN will maintain the MPR at its current elevated level to consolidate its hard-won gains against inflation, only considering a pivot to a more accommodative stance (a 50–100 basis points MPR cut) once there is clear and sustained evidence of disinflation, to support real sector credit expansion and investment activity. Nonetheless, we believe that the elevated levels of insecurity, especially in food-producing and industrial regions, will continue to adversely impact output, logistics and domestic confidence.

Figure 3: Headline Inflation (%)

Source: NBS, Agusto & Co. forecast

Exchange Rate Outlook: Anchoring Stability

We expect the naira to trade broadly within the ₦1,500–₦1,600/$ band through year-end, barring unforeseen external shocks or a dramatic reversal in oil earnings. The sustainability of this stability will depend on continued CBN interventions, global oil price trends, effective management of capital flows and government reforms aimed at further boosting export receipts and investor confidence. While there are concerns regarding the drawdown of external reserves caused by aggressive currency defence, we opine that moderate reserve declines can be absorbed so long as oil receipts and remittance flows remain resilient.

New Borrowing: Fuel for Growth or Fiscal Strain?

In July 2025, the Nigerian Senate approved a significant foreign borrowing package exceeding $21 billion aimed at funding critical infrastructure and development initiatives for the 2025–2026 fiscal years. This comprehensive plan includes concessional loans with extended maturities, euro and yen-denominated debt and domestic bond issuances aligned with the government’s Medium-Term Expenditure Framework. While this initiative aims to ensure the full implementation of the 2025 Appropriation Act, it is also likely to exacerbate Nigeria’s debt servicing challenges, with ₦16.3 trillion already proposed for debt servicing in 2025 (44.8% of projected revenue in 2025). While this infusion is expected to provide essential capital for long-term growth, the government must balance these inflows with revenue-enhancing reforms and fiscal discipline to avoid further fiscal strain in H2 2025.

Policy Credibility as the Anchor: Building Trust, Attracting Capital

Going forward, the integrity and consistency of policy implementation will be paramount to sustain confidence. The credit rating upgrades from Moody’s (to B3 from Caa1) and Fitch (to B from B-) in H1 2025 reflect growing international confidence linked to clearer reform trajectories. Continued efforts by the CBN to deepen FX market liquidity and promote a market-driven exchange rate will be critical in attracting stable foreign direct investment (FDI), beyond volatile portfolio inflows. Entrenching fiscal discipline and enhancing revenue mobilisation remain imperative. Reducing the debt-service-to-revenue ratio sustainably is essential to redirect resources towards infrastructure and human capital investments – the true engines of long-term development.

Conclusion: A Precarious Balancing Act Towards Prosperity

Nigeria’s economy finds itself at a pivotal moment. The first half of 2025 has demonstrated tangible progress amid persistent challenges. Managing inflation without stifling growth, maintaining currency stability without excessive depletion of reserves and addressing fiscal constraints while protecting vulnerable populations constitute an intricate balancing act. The path ahead demands steady hands and resolute policy continuity. Incremental improvements, rather than sweeping reforms, will underpin the nation’s ability to conclude the year with stronger economic fundamentals and restored investor confidence. The commitment to reform and prudent management thus far offers hope that 2025 may close on a note more promising than it began.