Election-related uncertainty looks set to take its toll on Nigeria’s foreign investment inflows in the run-up to the February 2023 polls. This is coming on the heels of the COVID-19 pandemic which presented a new and unprecedented source of investor risk that depressed investor confidence to new lows. Capital flows into Nigeria in Q1’22 fell 17.5% year-on-year and 28.1% q-o-q to $1.57bn according to data from the National Bureau of Statistics (NBS). This is also the lowest level of inflow for a first-quarter since Q1’17 ($313.61mn). Capital imports have remained sluggish since the recession of 2016 reflecting subdued business and investor confidence. While foreign portfolio investment (FPI) continues to dominate capital imports, ranging between 50-70% of annual inflows over the last 5 years, foreign direct investment (FDI) has stayed significantly lower at between 4% and 11%.

A closer look at the figures reveals that FDI inflows ($154.97mn) in Q1’22 was the second-lowest first-quarter inflow since Q1’16 ($174.46mn) – the start of a recession. FDI inflows are crucial for economic growth that is both sustainable and long-term, job creation, higher incomes and technological transfer. According to the World Bank, “FDI supports development in other ways besides providing capital. It helps developing economies integrate into international markets. It also spurs productivity gains by increasing competition and by enabling knowledge to spread across borders”. We expect Nigeria’s FDI inflows to remain tepid and significantly lower than the $10bn annual average required to achieve economic growth in the short term. This is largely down to its lack of competitiveness as an investment destination.

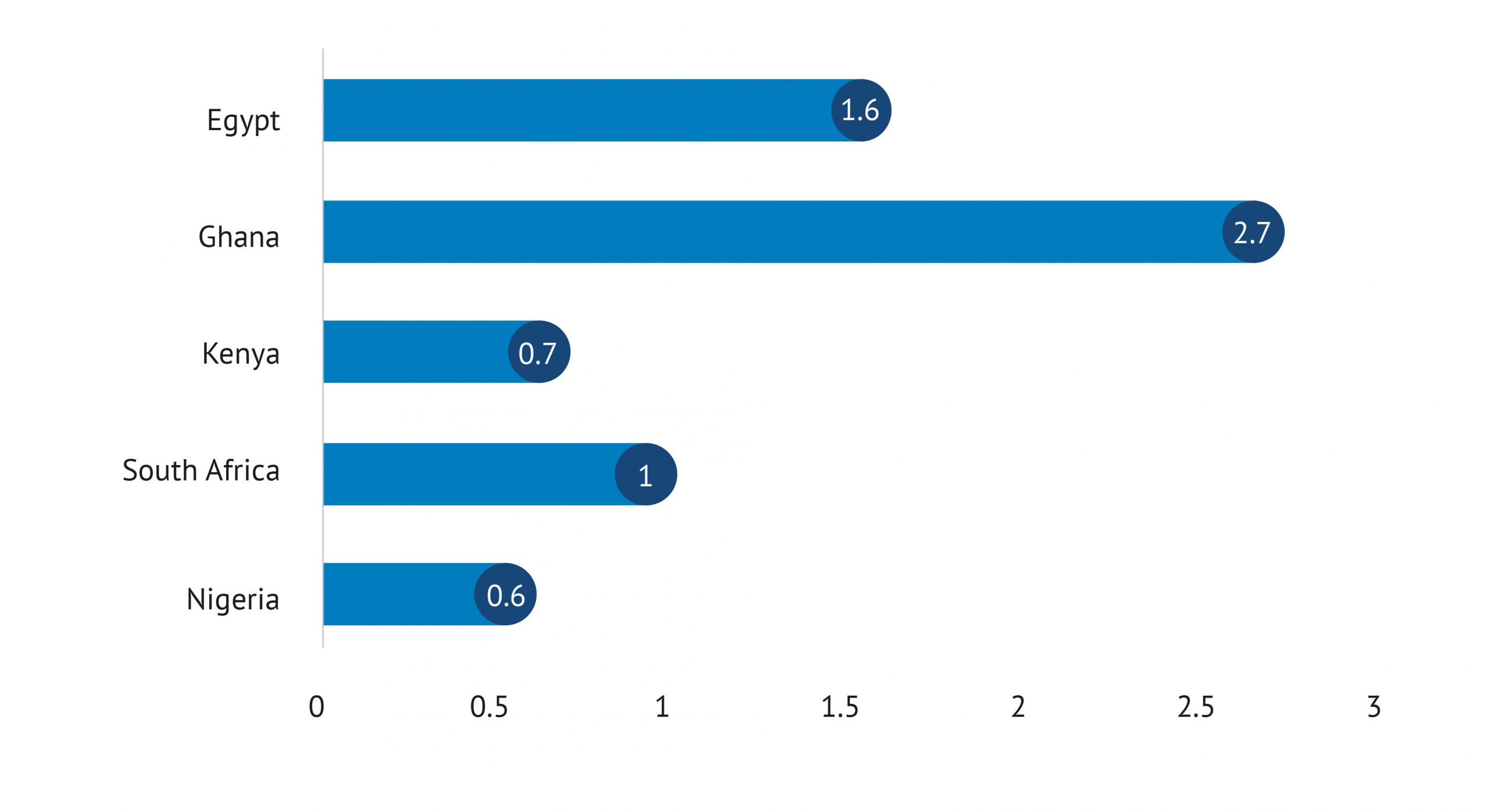

Figure 2: FDI as a % of GDP (2020)

Source: World Bank

How Competitive is the Nigerian Economy?

Nigeria ranked 116th (48.3 points) globally and 16th in Africa in the last Global Competitiveness (2019) ranking by the World Economic Forum (WEF). It was also one of 27 African countries that scored below 50 points. The Global Competitiveness Index (GCI) 4.0 covered 141 economies and measured national competitiveness, which is defined as the set of institutions, policies, and factors that determine an economy’s level of productivity, which in turn determines the level of prosperity that a country can achieve. Nigeria’s healthcare, institutions, skills, infrastructure, macroeconomic stability, and financial system continue to perform inadequately. The recent spate of insecurity further weakens the business environment, raises the cost of doing business and lowers the ability to compete against cheaper imports.

Figure 2: Nigeria Competitiveness Report Card (2019)

Source: World Economic Forum Global Competitiveness Index 2019

Source: World Economic Forum Global Competitiveness Index 2019

What structural reforms must be enacted to boost competitiveness?

The challenge of building competitiveness is one that successive Nigerian governments have, through seemingly well-thought-out plans, attempted to tackle. Nigeria’s current medium-term economic plan – National Development Plan (NDP) 2021-2025 – which succeeds the Economic Recovery & Growth Plan (2017-2020) has at its centre, pillars that align broadly with those of the GCI. The plan makes the diversification of the economy a top priority; therefore, it emphasises infrastructure investment, reforms to lessen reliance on crude oil, lower inequality and unemployment, strengthen institutions, and address governance issues. The plan is big on private sector participation, and through incentives, hopes to galvanise private sector savings to the tune of ₦298.3 trillion which is 85.7% of the NDP’s required funding. This will be crucial in bridging the infrastructure gap (estimated at $150bn annually over the next 30 years) and providing Nigeria with the transformational investment impetus that will have the desired ripple effect on productivity, incomes and GDP growth.

Currency as a tool for competitiveness

Concurrently, the Federal Government of Nigeria (FGN) will attempt to eliminate policies that have been skewed towards protectionism and implement the African Continental Free Trade Agreement (AfCFTA). This should bolster Nigeria’s non-oil exports and build external competitiveness. However, Nigeria’s long-standing preference for a managed exchange rate, aimed at reducing import costs and keeping the FGN’s external obligations low, has continued to stifle external competitiveness. The argument against a market-determined exchange rate rests largely on Nigeria’s import dependence and how a weaker naira will raise the prices of consumer goods and erode incomes. However, given that importers are currently sourcing as high as 80% – 90% of their FX from the parallel market, the argument becomes untenable.

The current premium between the official (₦417/$) and parallel market (₦610/$) exchange rates, at ₦193/$, is a clear indication that the official rate is overvalued. Beyond the arbitrage that this creates, importers seek access to FX using the official exchange rate while exporters want to convert their proceeds with the parallel market rate. The official rate results in relatively cheaper imports, but has kept non-oil exports more expensive. This logic works in reverse for the parallel market rate – makes imports more expensive and incentivises exports. Somewhere between the official and the parallel market rates lies an equilibrium (market-clearing) rate that would achieve both internal and external balances and promote efficient resource allocation while also doubling as a strategic tool to make exports more competitive. The CBN has indicated that it intends to allow full market mechanisms in the future; however, such a transition will require careful planning and management as Nigeria remains dependent on imports for its day-to-day consumables and the inflationary impact could trigger unrest.

The Elephant in The Room

For years, a reform agenda has been promoted but often not implemented or is openly contradicted for being politically inexpedient. Any attempt at structural reform will be incomplete without addressing the elephant in the room – petrol subsidies. The FGN is set to spend an estimated ₦4 trillion on petrol subsidies in 2022 to keep prices at ₦162 per litre. At the same time, the NNPC remitted ₦0 to the consolidated revenue account in Q1’2022. As a result, JP Morgan downgraded Nigeria from “overweight” to “market weight” on its emerging market sovereign recommendations list. According to the investment bank, “Nigeria’s fiscal woes amid a worsening global risk backdrop have raised market concerns despite a positive oil environment”. This downgrade will only further dampen investor confidence and impact capital flows negatively.

The elimination of subsidies and the deregulation of the downstream sector of the petroleum industry will trigger competition, efficiency, and attract investment in domestic refining – the absence of which has been a significant drain on Nigeria’s foreign exchange earnings over the years. As the African Continental Free Trade Agreement (AfCFTA) opens Nigeria’s borders to increased competition from the rest of the continent, Nigerian manufacturers must compete or risk losing to peers on the continent. Competitiveness must be the cornerstone and catalyst on Nigeria’s path to sustained and inclusive growth. The transition to competitiveness and away from oil dependence will require market-oriented structural transformation that is both holistic and deep-seated.